The Cast List of the Chinese Drama 'TRANSFER GOLD HAIRPIN' Officially Announced, Featuring Tian Xi Wei and Yan An

The cast list of TRANSFER GOLDEN HAIRPIN has been officially announced, with Tian Xi Wei playing two roles and Yan An as the prince.

Kapanlagi.com - The South Korean entertainment world is currently buzzing with unpleasant news. This time it involves the shining star Cha Eun Woo who is allegedly entangled in a tax case.

The actor and K-Pop idol from ASTRO is reported to face a bill of over IDR 240 billion. This fantastic figure has certainly surprised many parties.

This issue has suddenly become a hot topic, sparking speculation among fans and the media. The agency Fantagio also immediately provided an official statement.

You can also check more information at Liputan6.com.

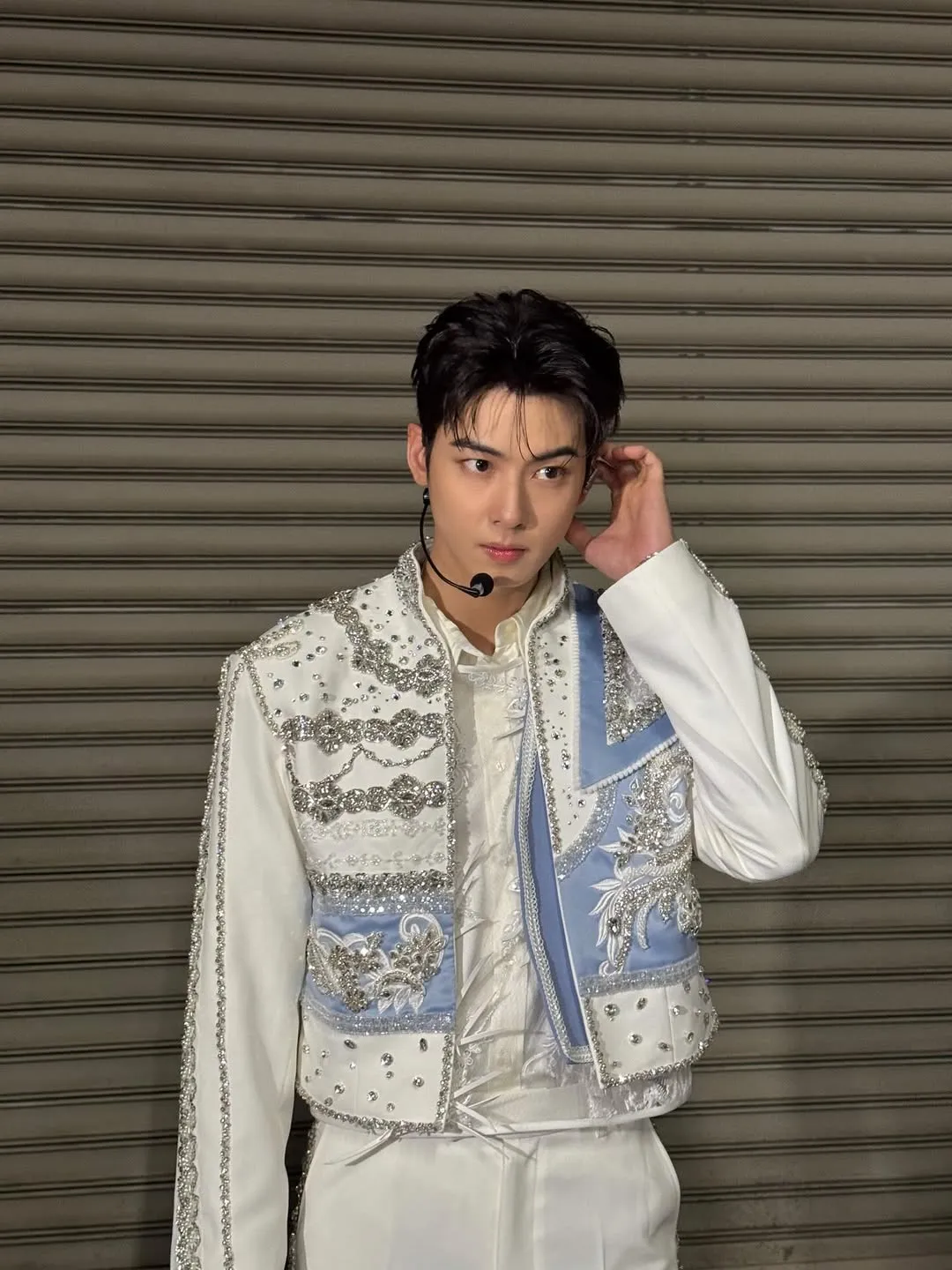

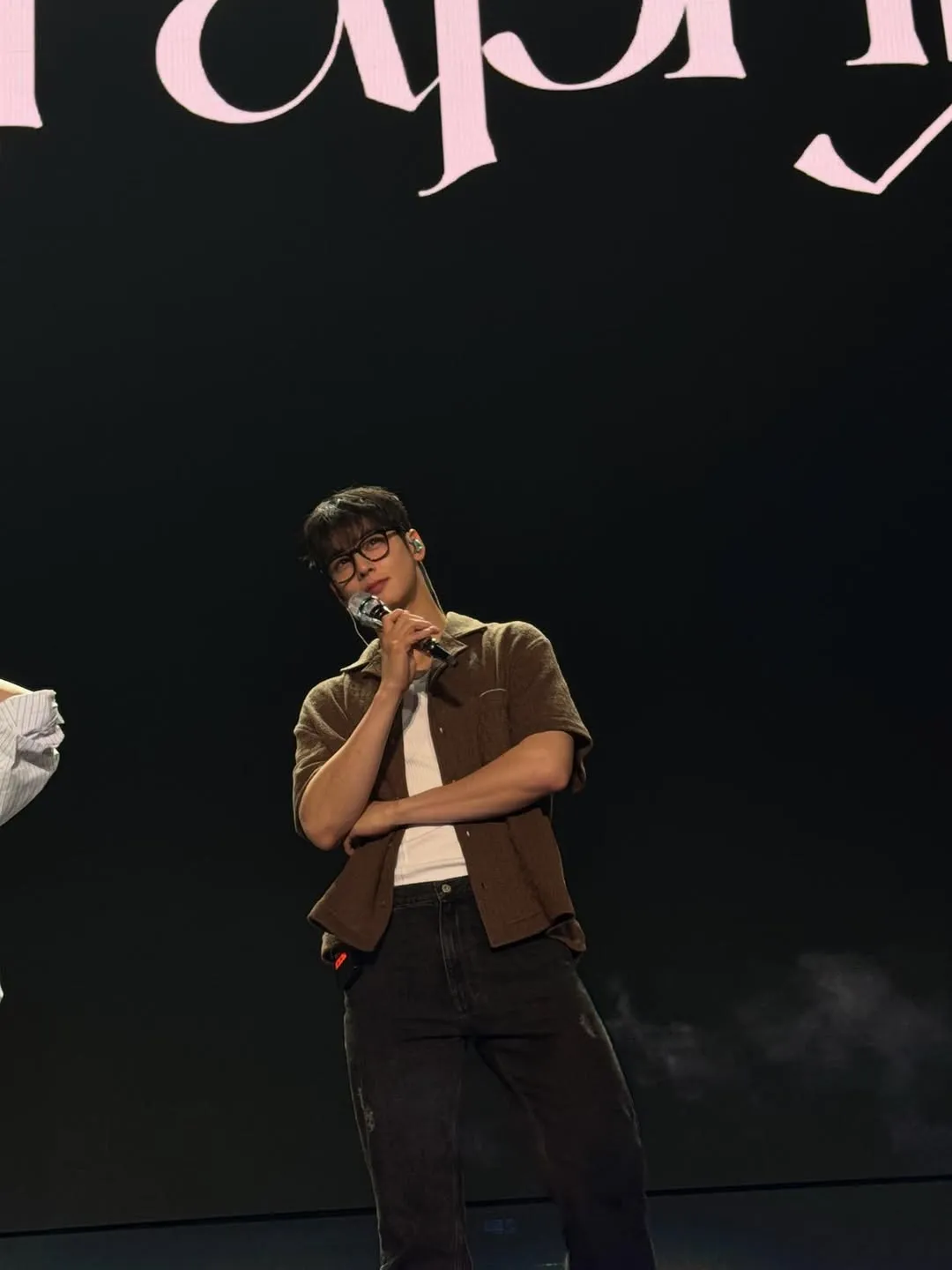

Cha Eun Woo Allegedly Involved in Tax Case/credit: Instagram @eunwo.o_c

Cha Eun Woo, known as an ASTRO idol and top actor, is currently under investigation by the National Tax Service (NTS) of South Korea. This investigation arises from allegations of tax evasion involving his name, which has drawn significant public attention.

This news first emerged and became a focal point because it involves one of the leading Hallyu stars. The NTS has indeed been actively ensuring tax compliance among celebrities and high-earning public figures.

Cha Eun Woo is suspected of being involved in a tax case/credit: Instagram @eunwo.o_c

In the development of this case, Cha Eun Woo has been informed to pay more than ₩20 billion KRW as an astonishing additional tax. This fantastic amount is equivalent to about Rp240 billion, making it one of the largest sums ever imposed on a Korean celebrity.

The size of this tax bill indicates the seriousness of the alleged violations being investigated by the tax authorities. Of course, this figure raises many questions and concerns among fans and the general public.

Cha Eun Woo is suspected of being involved in a tax case/credit: Instagram @eunwo.o_c

This tax allegation case began from an intensive tax audit conducted by NTS before Cha Eun Woo underwent military service in July last year. This audit procedure is a standard step often applied by tax authorities to high-income individuals.

The main allegation in this case points to a one-person agency established by his mother. The agency is suspected of being used to unlawfully reduce Cha Eun Woo's tax burden, prompting further investigation.

Cha Eun Woo is Suspected of Being Involved in a Tax Case/credit: Instagram @eunwo.o_c

The tax authority assessed the company established by Cha Eun Woo's mother as a shell company, not a legitimate management agency. This assessment is based on the suspicion that the company did not provide any real or substantial services as it should.

This scheme allegedly allowed Cha Eun Woo's income to be funneled through the company at a lower tax rate. Such patterns often become the focus of NTS investigations to ensure there is no abuse of tax rules.

Cha Eun Woo is Suspected of Being Involved in a Tax Case/credit: Instagram @eunwo.o_c

The impact of this finding also extends to Cha Eun Woo's main agency, Fantagio, which is also subject to additional taxes. Fantagio must pay approximately 8.2 billion KRW, equivalent to Rp98 billion, as additional tax.

The tax authorities stated that Fantagio processed fake tax invoices from a company owned by Cha Eun Woo's mother. The objection filed by Fantagio through the pre-assessment process has also been rejected, indicating a connection.

Cha Eun Woo is suspected of being involved in a tax case/credit: Instagram @eunwo.o_c

Cha Eun Woo's side firmly denies the tax evasion allegations directed at him. They emphasize that the company in question is a legitimate management agency operating in accordance with applicable laws.

Currently, Cha Eun Woo's side has filed an official objection against the tax authority's decision. They are awaiting the results of the review of the objection that has been submitted, hoping for further clarity.

Cha Eun Woo is suspected of being involved in a tax case/credit: Instagram @eunwo.o_c

If the pre-assessment objection is rejected, Cha Eun Woo still has the option to pursue further legal action to defend himself. He can continue the dispute through the Tax Court or the Audit and Inspection Agency, seeking justice.

Cha Eun Woo's side is also reported to be considering bringing the case directly to the Tax Court. This step shows their seriousness in facing the widespread allegations.

Cha Eun Woo Allegedly Involved in Tax Case/credit: Instagram @eunwo.o_c

Cha Eun Woo, whose birth name is Lee Dong Min, was born on March 30, 1997, and is a renowned singer, actor, and model from South Korea. He is widely known as a member of the boy group ASTRO, which debuted in 2016 and immediately captured attention.

In addition to his brilliant music career, Cha Eun Woo has also successfully pursued an acting career by starring in several popular Korean dramas. Some of these include MY ID IS GANGNAM BEAUTY, TRUE BEAUTY, and A GOOD DAY TO BE A DOG.

What are the allegations against Cha Eun Woo? Cha Eun Woo is alleged to be involved in a tax case by the National Tax Service (NTS) of South Korea related to tax evasion.

How much additional tax does Cha Eun Woo have to pay? Cha Eun Woo has been informed to pay more than ₩20 billion KRW, equivalent to approximately Rp240 billion, as additional tax.

What is Cha Eun Woo's response to these allegations? Cha Eun Woo's side denies the allegations of tax evasion, asserting that the agency is legitimate, and has filed an official objection to the tax authorities.

Want to know the latest news in the entertainment world? Check it out directly at Kapanlagi.com. If not now, when?

(kpl/mda)

Cobain For You Page (FYP) Yang kamu suka ada di sini,

lihat isinya

The cast list of TRANSFER GOLDEN HAIRPIN has been officially announced, with Tian Xi Wei playing two roles and Yan An as the prince.

The song The Fate Of Ophelia by Taylor Swift is banned from playing while driving due to its fast tempo that can disrupt driving concentration. For more details, check here KLovers.

The Final Showcase Schedule for Top 17 INDONESIAN IDOL SEASON 14 on January 26-27, 2026, to determine the Top 15.

Let’s take a look at the complete review regarding Jang Wonyoung's contribution to the new IVE song writing below.

The love story of El Rumi and Syifa Hadju enters a new chapter! Their official engagement will be broadcast live, ready to make hearts flutter across Indonesia.

Manohara Odelia Pinot is back in the fashion world with her latest photoshoot as a model. Check out her pictures here, KLovers.

One of the most touching themes in Korean dramas is the theme of love tested by an unavoidable career and time. The stories often showcase the hesitation, worries, and extraordinary sacrifices of their characters.

Meghan Trainor welcomes her third child via surrogate due to childbirth trauma and mental health issues.

Let's take a look at some sweet photos of Steffi Zamora and Nino Fernandez below.

Let's take a look at some of Lyodra's vacation photos in Copenhagen below!

Recommendations for Chinese dramas with satisfying endings, resolved conflicts, and story closures that bring relief.

The song Forgot Password is a composition rich in deep meaning. Released on July 21, 2023, in the album Hindia Lagipula Hidup Akan Berakhir, this song immediately captured the public's attention.