YG Entertainment Announces Additional Schedule for BLACKPINK's World Tour, Only Stopping in 2 Asian Cities

BLACKPINK officially announced the schedule for their 2025 World Tour with 9 destination cities, including only 2 cities in Asia.

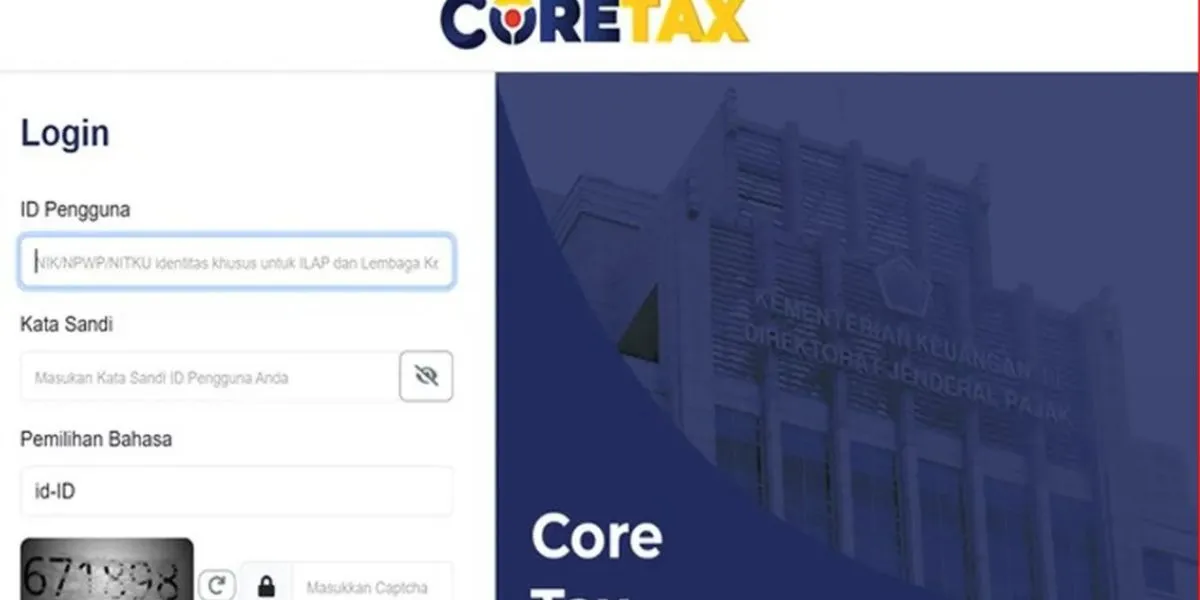

Kapanlagi.com - The Directorate General of Taxes (DJP) has just announced an exciting policy that is sure to bring a breath of fresh air for taxpayers! In this bold move, DJP officially removes administrative sanctions for taxpayers who experience delays in tax payments or deposits. This decision is outlined in KEP-67/PJ/2025, as part of the transition to a more modern DJP Coretax system. With this policy, fines that usually burden taxpayers due to delays in payment or reporting of the Annual Tax Return (SPT) can now be waived.

This step is taken in response to various obstacles that have arisen due to the implementation of the new Coretax system. Since its introduction, many taxpayers have faced technical difficulties, causing them to be late in fulfilling their tax obligations. DJP wants to ensure that taxpayers do not feel disadvantaged due to the administrative system changes that are still in the adjustment phase.

The official post related to this policy was uploaded by the account @perpajakan.ddtc on Instagram on February 28, 2025. This post received 90 likes within 12 hours of being published. Although there are no comments yet, this information has caught the attention of many taxpayers who want to know how to obtain the waiver of sanctions.

The Directorate General of Taxes (DJP) has just issued an important decision in response to the launch of the innovative Coretax system, designed to bring efficiency and transparency to tax management. However, during the transition period, some taxpayers are facing a number of technical challenges.

Realizing that delays in tax reporting and payments are not entirely due to their own mistakes, the DJP, through KEP-67/PJ/2025, has taken a wise step by removing administrative sanctions for delays caused by factors beyond the control of the taxpayers. This is a concrete step by the DJP in supporting taxpayers amidst the ongoing changes.

The removal of administrative sanctions applies to two main conditions: delays in tax payments or deposits, as well as delays in the reporting of tax returns (SPT).

For delays in tax payments, the removal of sanctions applies to several types of taxes, including:

Meanwhile, for delays in reporting, the removal of sanctions includes the monthly tax returns of Income Tax 21/26, Unified Income Tax, and the monthly Stamp Duty Tax Returns. The deadlines for delays that can still be exempted from sanctions have also been specified in this decision.

The cancellation of sanctions only applies to taxes due during the transition period of the Coretax DJP system. For late payments, here are the deadlines:

For late submission of the Annual Tax Return (SPT), here are the deadlines:

With these deadlines, taxpayers have flexibility to adjust payments and reporting without incurring administrative penalties.

The Directorate General of Taxes (DJP) announced an interesting step: the elimination of penalties will be carried out without the need to issue a Tax Bill (STP), so taxpayers do not need to go through the hassle of submitting a special application to enjoy this reduction in fines.

For those who have already received an STP due to delays, the Head of the DJP Regional Office will automatically remove the administrative sanctions. This policy will take effect on February 27, 2025, and the entire process of elimination will occur administratively, without requiring intervention from the taxpayer.

This new policy is a breath of fresh air for taxpayers affected by the implementation of the DJP's Coretax system. With the elimination of penalties, they can now breathe a sigh of relief without worrying about fines due to late payments or reporting caused by system changes.

Moreover, this decision also provides a valuable opportunity for taxpayers to adapt to the DJP's Coretax, making the payment and reporting process more efficient in the future. For those who are already familiar with the old system, this is the perfect time to delve deeper and maximize the use of the DJP's Coretax without the burden of administrative fines.

Yes, as long as the delay in payment or reporting is due to the transition of the Coretax DJP system and in accordance with the provisions in KEP-67/PJ/2025.

No, the DJP automatically waives this penalty without the need for an application.

If the STP has been issued, the Head of the DJP Regional Office will waive the penalty without the need for an application from the taxpayer.

(kpl/rmt)

Cobain For You Page (FYP) Yang kamu suka ada di sini,

lihat isinya

BLACKPINK officially announced the schedule for their 2025 World Tour with 9 destination cities, including only 2 cities in Asia.

Aura Kasih celebrates her 38th birthday with her closest friends. This warm and simple moment captures attention.

Thariq Halilintar's happy expression when he learned that his first child is a boy, a heartfelt and surprising gender reveal.

Syahrini's luxurious rings and jewelry are back in the spotlight. Her collection of accessories is estimated to be worth billions of rupiah.

Rizky Billar got punched by Baby Levian after trying to flirt with Soimah, Lesti Kejora just laughed at the incident.

Anya Geraldine appears differently in the MENDADAK DANGDUT remake. The official first look has been released, what does her transformation look like?

A funny moment of Ricky Harun getting annoyed because his wife took a long time to choose a menu, but in the end, she got confused herself.

How to log in to GTK Info 2025 to check teacher certification allowances, solutions for errors, and data verification through PTK Datadik.

The definition of Mukadimah and a collection of Mukadimah that you can use to start lectures, religious studies, speeches, and more.

Get ready, Ramadan 2025 is just two days away! Know the official schedule from the Government, Muhammadiyah, and NU as well as preparations to welcome the holy month.

Juz 30 contains short surahs that are suitable to read during Ramadan. Here is the list of surahs in order and their virtues.

Tomy Winata, a successful Indonesian entrepreneur, built his business from scratch to become part of the 9 Dragons group. Get to know him better.