El Rumi's Collaboration Moment at The Changcuters' 20th Anniversary Concert, Netizens: The Most Handsome Intern Vocalist

El Rumi caught attention as a guest star at The Changcuters' 20th Anniversary concert, dazzling with his duet.

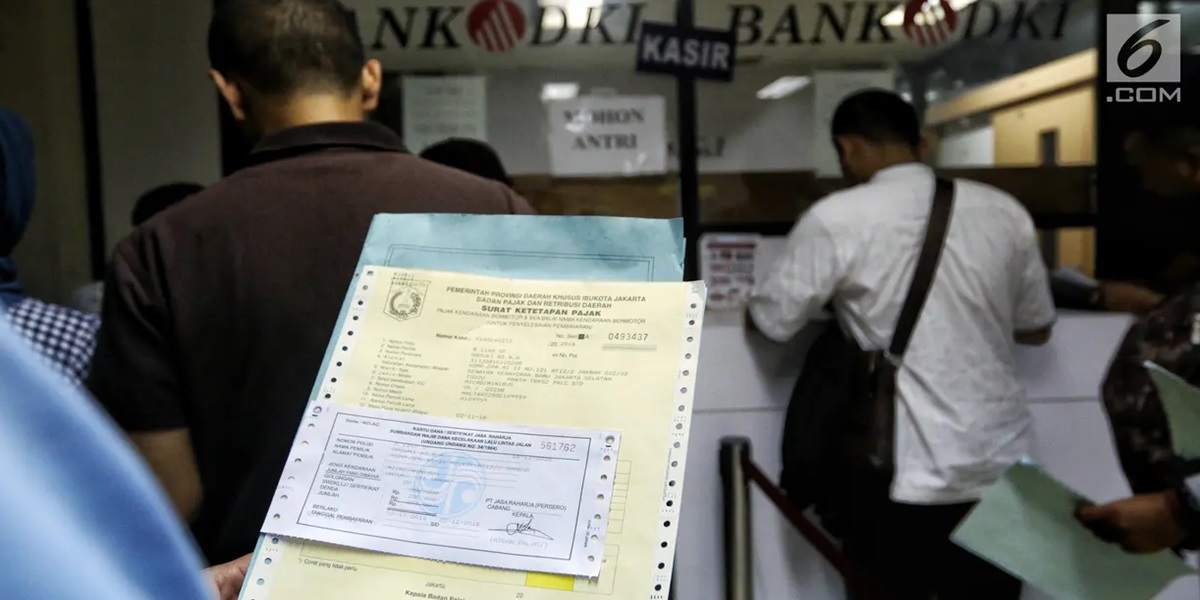

Kapanlagi.com - Starting January 5, 2025, Indonesia will face significant changes in the motor vehicle taxation system. The government will launch the motor vehicle tax option (PKB), which is an additional levy for your annual tax. This policy is regulated under Law Number 1 of 2022 concerning Financial Relations between the Central Government and Regional Governments (HKPD).

Although it may sound burdensome, this PKB option actually has a noble purpose: to increase regional income and support development at the district/city level. With this option, local governments are expected to be more independent in funding various development programs and public services.

However, before we proceed further, it is important for us to deeply understand what the PKB option is, how to calculate it, and its impact on motor vehicle owners. This article will thoroughly discuss the PKB option, so you can prepare yourself well to face this change.

Don't miss this important information! Check out the summary compiled by Liputan6, Friday (13/12).

The Vehicle Tax Option (PKB), or additional levy imposed by the local government, has now become a major focus in efforts to increase local revenue (PAD). According to Law Number 1 of 2022 concerning Financial Relations between the Central Government and Regions, local governments have the authority to impose this option as a percentage of the principal PKB that must be paid.

This step is expected to provide financial independence for local governments, enabling them to finance various development programs and better public services for the community.

To calculate the Vehicle Tax Option (PKB), you need to understand the option rate set by the local government, which can vary but can reach a maximum of 66% of the principal PKB. The first step is to determine the Motor Vehicle Selling Value (NJKB), which is the market price of the vehicle determined by the government.

Next, calculate the Tax Base for Motor Vehicles (DPKB) by multiplying the NJKB by the vehicle weight. From there, you can calculate the principal PKB by multiplying the DPKB by the applicable PKB rate.

Finally, to calculate the PKB option, multiply the principal PKB by the established option rate. For example, if you have a car with an NJKB of Rp200,000,000 and a weight of 1,050, along with a PKB rate of 1.5% and an option rate of 50%, the calculation will result in a total tax payable of Rp4,725,000.

Thus, understanding these steps is very important so that you do not make mistakes in fulfilling your vehicle tax obligations!

The PKB tax is applied to all types of motor vehicles registered in Indonesia, including both two-wheeled and four-wheeled vehicles.

Here are some types of vehicles subject to the PKB tax:

It is important to note that motor vehicles that receive exemptions or reductions from the PKB tax will not be subject to the PKB tax.

The government has set the year 2025 as an important moment for motor vehicle owners across Indonesia, where they must be prepared to face a new policy in the form of the PKB tax surcharge.

This means that when paying vehicle taxes, owners will experience an additional cost that will certainly impact their budgets. However, there is good news: the tax increase is capped at a maximum of 10% of the total tax previously paid.

More than just an increase in costs, the government is optimistic that this PKB surcharge will bring a breath of fresh air to the community, with hopes of improving infrastructure quality and better public services.

Starting January 5, 2025, all corners of Indonesia will feel the impact of the implementation of the PKB option, which will be enforced simultaneously! This is a significant step that will bring substantial changes in various regions, and the community is eagerly awaiting its implementation.

Motor vehicles that receive exemptions or reductions in the Motor Vehicle Tax (PKB) will enjoy additional benefits, as they will not be subject to extra charges in the form of the PKB option. This is good news for vehicle owners who want to lighten their tax burden!

To find out the amount of PKB option you need to pay, simply visit the nearest Samsat office or check the official Bapenda website in your area. The information you need is just a finger away, so don't hesitate to find out!

Although the PKB option does not directly shake up the prices of new vehicles, the surge in vehicle tax costs can be an important factor considered by potential buyers when choosing their dream vehicle.

It is hoped that the implementation of the PKB option will be a breath of fresh air for regional revenue, which will later be allocated to fund various development programs and public services. From smoother road improvements to better school construction, as well as enhanced health facilities, all of this aims to create a higher quality and more prosperous life for the community.

(kpl/ank)

Cobain For You Page (FYP) Yang kamu suka ada di sini,

lihat isinya

El Rumi caught attention as a guest star at The Changcuters' 20th Anniversary concert, dazzling with his duet.

Tissa Biani appears in a pink hijab for her latest film. Her appearance is praised as beautiful, and the film's story has gone viral from a true story.

Profile of Cinta Richita, daughter of Femmy Permatasari, who graduated cum laude, with elegant charm and a passion for traveling.

The MAIN API series is trending in 32 countries with 60 million viewers. Luna Maya's acting as Nadine successfully evokes the audience's emotions.

Selena Gomez is officially engaged to music producer Benny Blanco. Check out their love story and career journey here.

Margin Wieheerm, a talented young actress who captures attention with her hijab style.

Glenn Victor dazzles the world at Mister International 2024 with a Papua-themed Asmat King costume.

The Hermes collection of Nursam Jhonlin, wife of Haji Isam, has captured the public's attention with astonishing prices reaching billions of rupiah and the exclusivity of limited edition items that make it even more special.

Jusuf Kalla was re-elected as the Chairman of PMI for the 2024-2029 term, despite this election being filled with tension due to the conflict of dual leadership. Controversy colored this process, especially with the emergence of claims of a rival management led by Agung Laksono, adding drama to the journey of this humanitarian organization.

Selena Gomez officially got engaged to Benny Blanco on 12/12/2024. The diamond ring and romantic moments fill her Instagram post.

Djakarta Warehouse Project (DWP) 2024 will amaze you on December 13-15 at JIEXPO Kemayoran, Jakarta! This biggest electronic music festival in Asia will present spectacular performances from international artists and the latest technological innovations.

A heartbreaking tragedy occurred when the Persewangi Banyuwangi bus group had an accident on the Probolinggo Toll Road, claiming the life of their coach, Syamsuddin Batola.