Kapanlagi.com - NPWP or Tax Identification Number is a unique identity given to taxpayers as a means of tax administration. Every citizen who meets the requirements is required to have an NPWP, including individuals who have income above the Non-Taxable Income (PTKP) and business entities. Every taxpayer can now try the way to create NPWP online that can be done easily.

NPWP has many benefits, such as ease in managing tax administration, requirements for opening bank accounts, and applying for credit. The way to create NPWP online is very easy and efficient, allowing you to manage everything from the comfort of your home or office. The advantages of managing NPWP online include saving time, avoiding queues, and a faster process.

Here is a review of how to create NPWP online that can be done easily. You will find complete information starting from the required documents to detailed steps to create NPWP online. With this guide, you will be able to understand the process of creating NPWP online better.

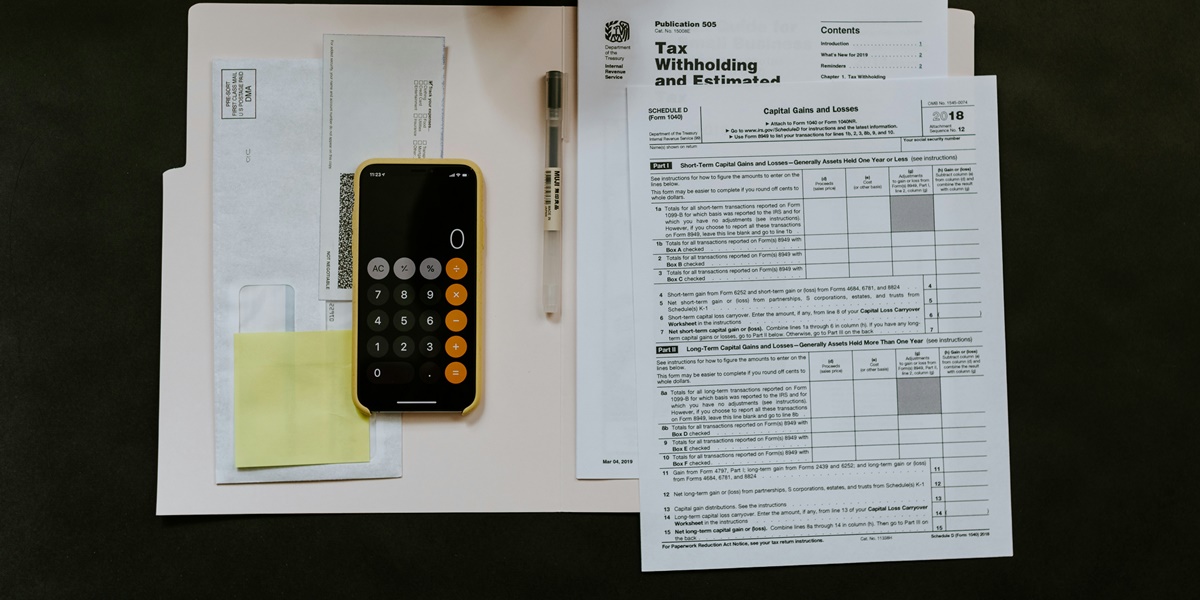

1. Documents and Terms and Conditions for Creating NPWP

Documents and Terms and Conditions for Creating NPWP (credit: unsplash)

Before starting the NPWP creation process, it is important for you to understand the documents and requirements needed. These requirements differ for individual taxpayers and business entities. By preparing the necessary documents, you can ensure that the online NPWP creation process runs smoothly.

Documents and Requirements for Creating NPWP for Individuals

To create a personal NPWP, you need to prepare several important documents. Make sure you have all these documents in original and photocopied before starting the online NPWP creation process:

- Valid Identity Card (KTP).

- Family Card (KK).

- Employment certificate (if you are an employee).

- Business license or business legality documents (if you own a business).

- Active phone number.

- Active email address.

Documents and Requirements for Creating NPWP for Companies

For those of you who want to create an NPWP for a company, the required documents are slightly different. Here are the documents you need to prepare:

- Deed of establishment of the company.

- Business Domicile Certificate (SKDU).

- Trading Business License (SIUP).

- Company Registration Certificate (TDP).

- ID card of the responsible person or company director.

- Personal NPWP of the responsible person or company director.

2. How to Create NPWP Online

How to Create NPWP Online (credit: unsplash)

Now, let's discuss the steps to create NPWP online through the official website of the Directorate General of Taxes. This process is relatively simple and can be completed in a few steps. By following this guide, you can create NPWP without having to visit the tax office in person.

Here are the steps to create NPWP online at the site ereg.pajak.go.id:

- Open your browser and visit the site ereg.pajak.go.id

- Click the "Register" menu on the main page.

- Select the type of taxpayer (Individual or Entity).

- Fill out the registration form with the appropriate personal data.

- Upload the required documents (according to the type of taxpayer).

- Double-check all the information you have filled in.

- Click "Submit" to send your application.

- Note the electronic receipt number that appears.

- Wait for a confirmation email from the Directorate General of Taxes.

- Once approved, you will receive the electronic NPWP via email.

3. How to Create NPWP Offline

How to Create NPWP Offline (credit: unsplash)

Although the method of creating NPWP online is easier and more efficient, some people may feel more comfortable with the offline method. The process of creating NPWP offline involves a direct visit to the nearest Tax Service Office (KPP). This process may take longer, but it has the advantage of direct assistance from tax officers.

If you choose to create NPWP offline, follow these steps:

- Visit the nearest Tax Service Office (KPP).

- Take a queue number at the registration counter.

- Prepare the necessary documents (according to the type of taxpayer).

- Fill out the NPWP registration form provided.

- Submit the form along with supporting documents to the officer.

- Wait for the verification process by the officer.

- If all requirements are met, you will receive an NPWP card.

- Sign the receipt for the NPWP card.

That is a brief overview of how to create NPWP online and offline. Those of you who are already classified as taxpayers but do not have an NPWP can choose which of the two methods above is most suitable for your needs.

Remember that having an NPWP is not just an obligation, but it also provides various benefits in your daily life and business. Hopefully, this is helpful and good luck trying!

(kpl/psp)

Disclaimer: This translation from Bahasa Indonesia to English has been generated by Artificial Intelligence.