Imitate Your Favorite Korean Drama Characters' Style, Grab the Special Discounts at iStyle.id

Grab the new iStyle Korea promotion and imitate the style of your favorite drama characters!

Kapanlagi.com - Talking about lifestyle never ends. Especially for millennials who are able to earn their own income, enjoying a lifestyle becomes one of the difficult things to avoid. Starting from going to work and stopping by a café to buy coffee, ordering favorite food online during lunchtime, then having dinner with friends or a partner at night.

This is not to mention the temptation of shopping promotions that almost always coincide with payday. Feeling like having money, shopping for this and that is done easily by tapping on e-commerce on a smartphone without hesitation. Suddenly, nearing the end of the month, the salary has decreased significantly and one is forced to eat instant noodles until payday arrives.

With such a lifestyle, it is understandable that older people often label millennials as a consumptive generation. However, it doesn't mean that saving is difficult for millennials, right? As long as you know how, enjoying a lifestyle and saving can be done simultaneously by millennials. How to do it?

For the sake of prestige, sometimes millennials are not aware of being trapped in a wasteful life, by almost always upgrading products, especially newly launched luxury goods.Change this mindset.Rather than spending a lot of money just to buy new products that actually do not have much innovation or difference from the products you previously owned, it's better to allocate it for other needs or savings.

Take the example of a mobile phone, as long as it can still be used to support work and lifestyle like opening social media or taking photos, there is no need to rush to buy a new one.The same goes for fashion, as well as other secondary or tertiary needs.Unless you are a model or trendsetter who is able to earn additional income by always upgrading the latest products.However, if it's just for showing off on social media, to get likes or good comments, it's better not to do it!

It's the same if you have a hobby of online shopping or going in and out of cafes to buy coffee, once or twice is fine.However, always remember that you don't get paid every day. Sometimes the price of a cup of coffee that you buy can be used to buy other basic necessities. Starting from rice, vegetables, fish, eggs, instant noodles, which will certainly be more economical if you can cook yourself. This principle is important to have when your salary is just enough and you live independently in another place. Be aware, don't spend money recklessly for the pleasure of being a young person, the end of the month is still far away!

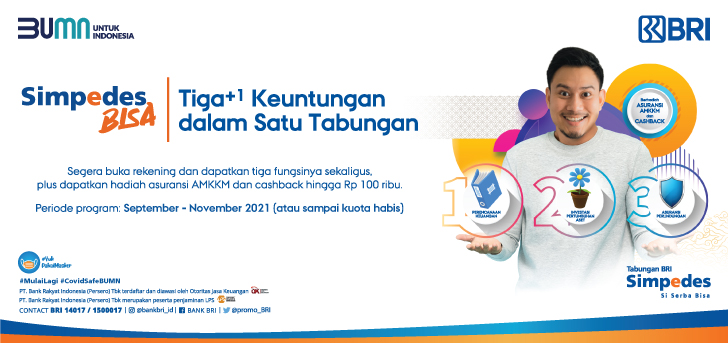

To make it easier to manage your financial planning, you can rely on Simpedes BISA. Not only providing savings facilities with transaction features in the main savings or savings to realize short-term savings. More than that, Simpedes BISA can also be relied upon for long-term investments with 2 options, namely BRIFINE General and Sharia with higher returns than savings (5-6%), so it can be relied upon for retirement preparation or other needs.

Not only that, Simpedes BISA also has a protection feature that provides customers with easy access to purchasing Micro Insurance policies such as AM-KKM, RumahKu, and Business Premises Damage. In addition to these 3 main features, Simpedes BISA also has other additional features, such as free monthly savings admin fees, minimum initial deposits of Rp50,000, free dormant balances, minimum monthly dream deposits and investments of Rp50,000 with autodebit, has ATM card facilities and BRIMO access, and dreams can be added up to 3 accounts.

All of these facilities can be obtained in 1 product, so that the needs of customers in managing their finances, both in the short and long term, can be met well. Therefore, instead of spending your salary without any savings just to enjoy the lifestyle, let's start managing your money properly through Simpedes BISA. Moreover, the requirements for opening an account are not complicated. In addition to being an Indonesian citizen aged at least 17 years old, you only need to come to the BRI or BRIMO office with your e-KTP and NPWP. Make sure you also have an active email. Check more information here.

(kly/tmi)

Cobain For You Page (FYP) Yang kamu suka ada di sini,

lihat isinya

Grab the new iStyle Korea promotion and imitate the style of your favorite drama characters!

Don't make things like this add to the burden of your life anymore.

Here are the locations that can be explored in 1 day while vacationing in Singapore:

There are various extraordinary achievements that make us proud from this virtual event. Let's take a look back at the highlights, shall we?

Add these newest shopping paradises in Singapore to your bucket list when you visit Singapore after the pandemic.

What will the excitement be like?

Through various interesting content presented, the sense of pride in Indonesia's diversity can continue to be promoted.

It's so fun that it can accompany exercise, you know!

Let's take a sneak peek at the leaks below!

There are many festivities ready to be presented to you, fans of Korean pop culture.

So, what are the unique ways to creatively store vaccination certificates? Here's the review!

What are the financial dramas that millennials fear?