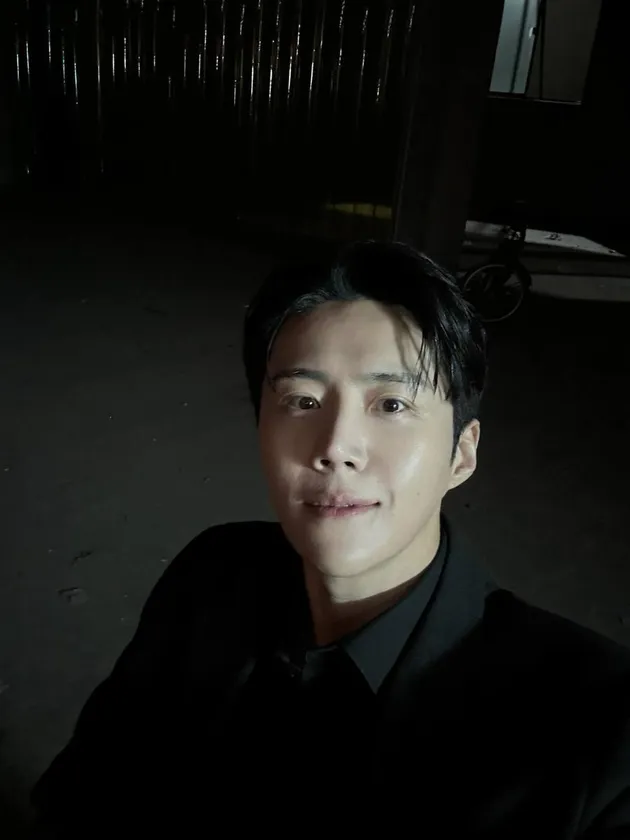

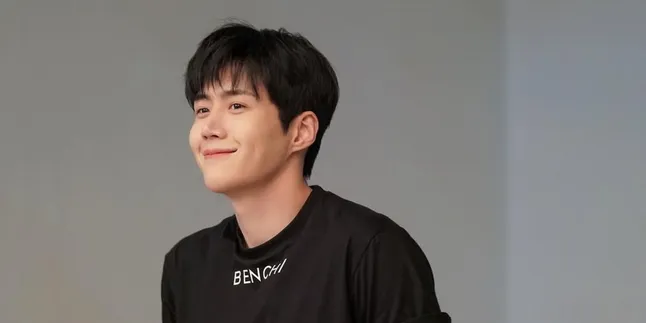

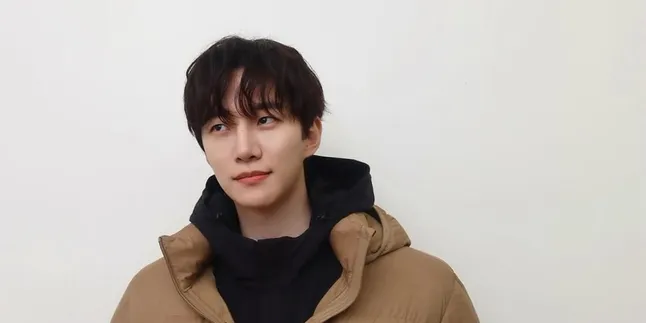

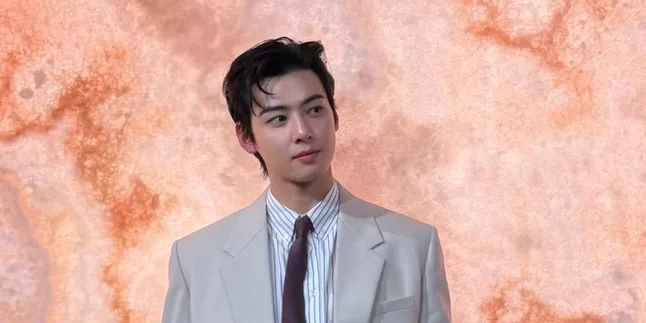

Korean actor Kim Seon Ho expressed his apology after his name was implicated in alleged tax issues related to the management of a personal business entity. The agency also spoke out, explaining the chronology of the establishment and the cessation of operations of the business entity.

Even with an official clarification, this controversy remains a public concern as it emerged during Kim Seon Ho's quite successful acting comeback.

Read the latest news about Kim Seon Ho on Liputan6.com. If not now, When else?