List of Korean Artists with the Highest Earnings Just from Advertisements

A list of Korean artists with the highest advertising earnings based on brand strength and public trust.

Kapanlagi.com - Kim Seon Ho, an actor known through Korean dramas and films, is now in the spotlight after recent reports emerged regarding alleged tax evasion. This issue has garnered attention due to its similarity to the tax case previously involving his agency mate, Cha Eun Woo, who is also facing similar accusations.

The allegation arose after Kim Seon Ho was suspected of establishing a family-owned company that operates in a suspicious manner. The structure of this company is similar to the case that previously affected fellow actor, Cha Eun Woo.

This case has sparked new speculation among fans and netizens regarding the transparency of artists' income and the role of agencies in managing taxes in the Korean entertainment industry, especially concerning practices similar to what Cha Eun Woo faced earlier.

Find more news related to Kim Seon Ho at Liputan6.com.

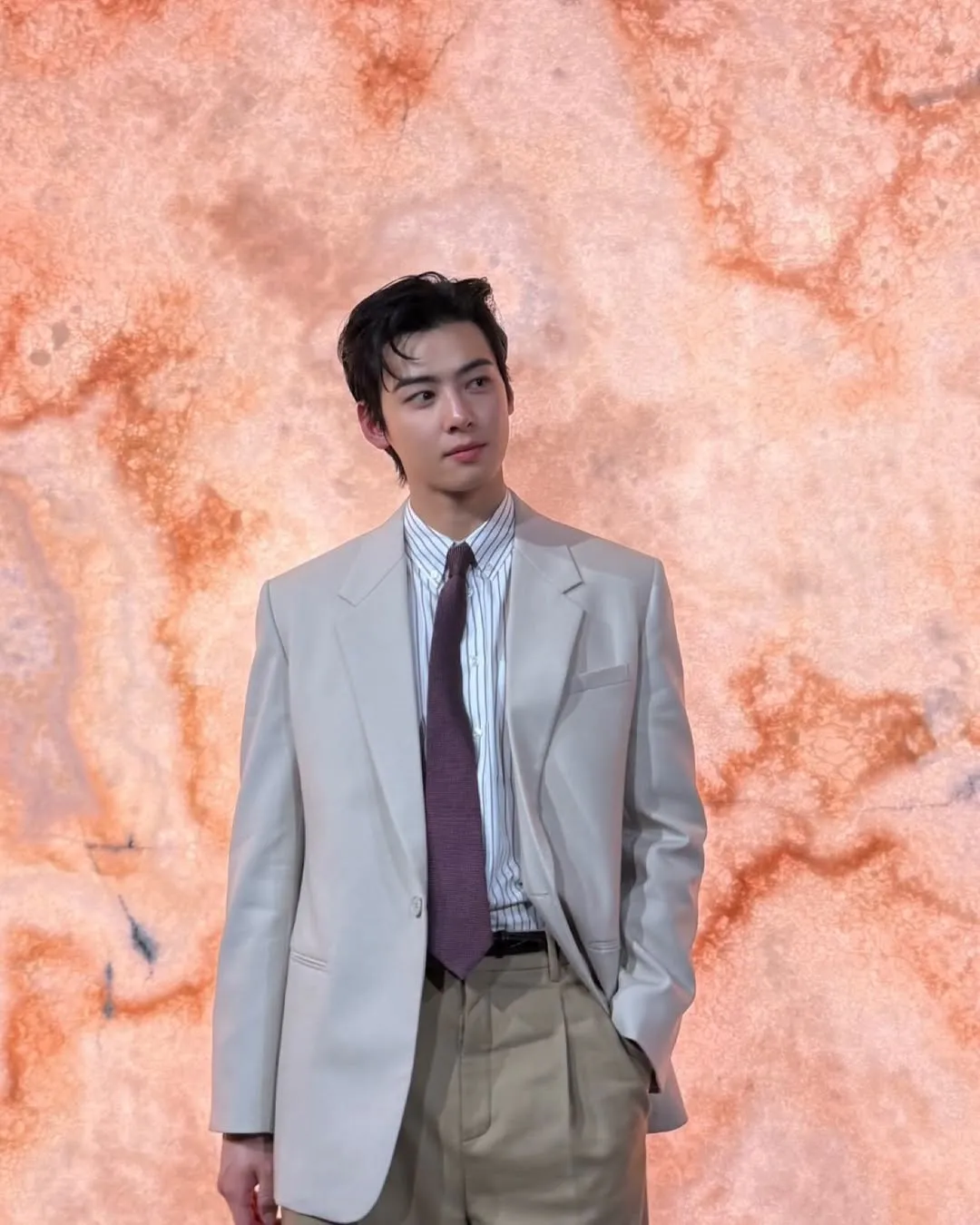

Kim Seon Ho is suspected of being involved in a tax case after establishing a company (credit:instagram.com/seonho__kim)

Allegations against Kim Seon Ho began to emerge publicly in early February 2026, after it was revealed that a company had been established in his name. The company was known to have been created in January 2024 and was registered using the same address as Kim Seon Ho's residence in Yongsan-gu, Seoul.

In the company's structure, Kim Seon Ho is listed as the CEO, while both of his parents are included in the board of directors. This arrangement then became a focus of attention as it raised suspicions that the company was not conducting any real business activities.

Kim Seon Ho is suspected of being involved in a tax case after establishing a company (credit:instagram.com/seonho__kim)

Based on testimonies and allegations put forward by analysts in the report, the company is accused of paying a large salary to Kim Seon Ho's parents. This salary was then reported to have been transferred back to the actor's personal account, raising suspicions about "fictitious labor costs".

This situation indicates potential income manipulation to lower taxes, as expenditures that appear to be business costs can reduce taxable profits.

Kim Seon Ho is suspected of being involved in a tax case after establishing a company (credit:instagram.com/seonho__kim)

In addition, the report mentioned that the company credit card was used by Kim Seon Ho's father for personal purposes, including consumption and non-business entertainment. This behavior adds to the allegations of misuse of company funds.

Not only that, the luxury car Genesis GV80 was also registered under the company's name, which analysts say could be used to reduce tax burden through expense calculations. The lack of clarity regarding real business activities raises suspicions that the company is merely an entity on paper.

Kim Seon Ho is suspected of being involved in a tax case after establishing a company (credit:instagram.com/seonho__kim)

In response to these allegations, actor Kim Seon Ho's agency, Fantagio, issued an official statement. They stated that the company in question was never established for the purpose of tax evasion.

According to Fantagio, the company was initially created for theater production activities and related activities, but since Kim Seon Ho signed an exclusive contract with Fantagio in March 2025, the company has not been conducting any real activities. Currently, the process of officially closing the company is underway in accordance with applicable laws.

Kim Seon Ho is suspected of being involved in a tax case after establishing a company (credit:instagram.com/eunwo.o_c)

This allegation draws attention because it resembles the tax issue that previously embroiled actor Cha Eun Woo, who is also under the management of Fantagio. The public has begun to associate the family business structure pattern in both cases as a pattern that triggers tax administration allegations.

Some analysts even highlight the possible role of the agency in the use of such structures, while the agency itself asserts the legal status of the company and the compliance of all parties with Korean tax laws.

Q: What is the tax allegation involving Kim Seon Ho?

A: The allegation states that Kim Seon Ho established a company registered at his home address to divert income and reduce tax burdens in a non-transparent manner similar to the case affecting Cha Eun Woo.

Q: How did Fantagio respond to these allegations?

A: Fantagio denied that the company was created for tax evasion purposes and stated that the company has been inactive since Kim Seon Ho joined and is in the process of dissolution according to the law.

Q: What is the connection between this case and Cha Eun Woo?

A: The case of Kim Seon Ho is compared to that of Cha Eun Woo because both artists are said to have a family business structure that raises similar suspicions regarding tax evasion.

Want to read more news related to Kim Seon Ho? Let's read now on KapanLagi.com. If not now, when?

(kpl/vna)

Cobain For You Page (FYP) Yang kamu suka ada di sini,

lihat isinya

A list of Korean artists with the highest advertising earnings based on brand strength and public trust.

The story of Korean actors who nearly pursued careers in different fields before unexpected events changed their lives.

Discover the list of K-Pop idols who have been involved in tax cases, including Cha Eun Woo and others.

The film STRAY KIDS: THE DOMINATE EXPERIENCE invites fans to experience the epic concert and behind-the-scenes moments of this famous boy group. Don't miss the synopsis, cast, and interesting facts.

Let's take a look, KLovers, at the photos and check out the news about Park Jihoon's latest appearance below.

Cha Eun Woo's military video was removed by the Korean Ministry of Defense after allegations of 20 billion won tax evasion surfaced.

Romantic Korean dramas remain a favorite among K-drama fans, with various titles that make it hard for viewers to move on. Let's explore romantic drakor recommendations that are ready to warm the hearts of KLovers!

Here is a list of recommendations featuring sad K-pop songs with deep lyrics and emotional melodies.

Portrait of Han Ga Eul, a rookie actress who went viral because of her visuals and her family connection to actor Won Bin.

Check out the profile of Cha Eun Woo, a K-Pop star and multi-talented actor currently facing allegations of tax evasion. What interesting facts are behind his persona? Find out here.

Cha Eun Woo uploaded a clarification and apology regarding the tax allegations via Instagram on January 26, 2026.

The currently airing Korean dramas have once again recorded interesting rating performances in the last week of January. Here’s the list for you, KLovers.