Kapanlagi.com - BI Checking is Individual Debtor Information (IDI) that records the smoothness of credit payments (collectibility).

BI Checking was previously known as an information service that contains credit history in the Debtor Information System (SID).

In this system, customer credit information is exchanged between banks and financial institutions.

Information in the system includes: mortgage debtor identities, owners and managers acting as debtors, financing amounts, and payment history.

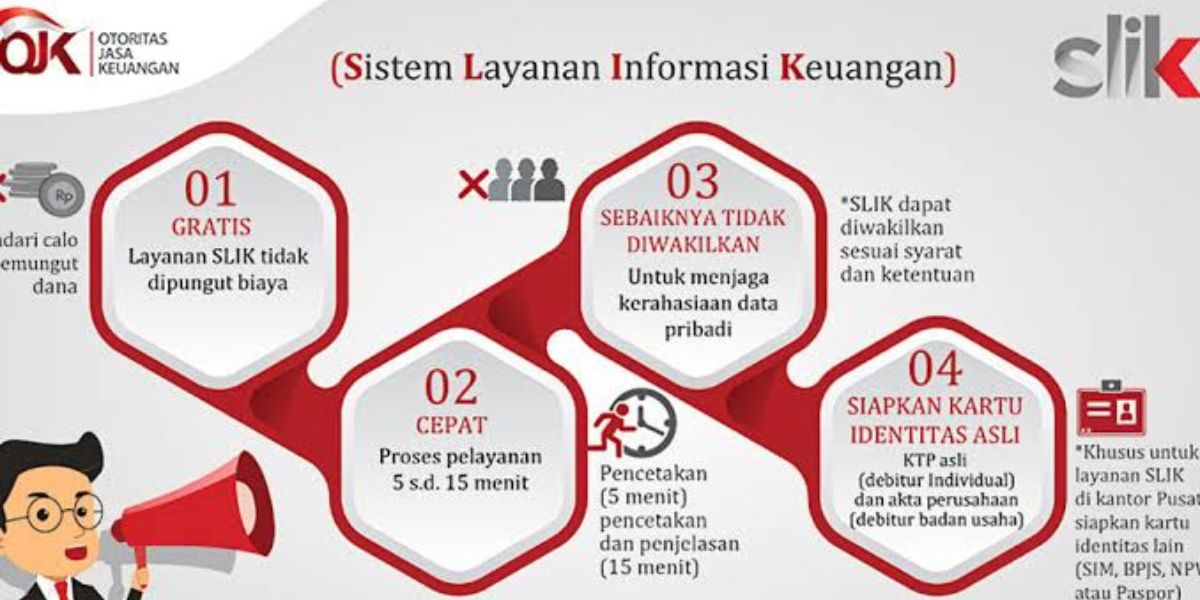

The Debtor Information System (DIS) has now changed its name to the Financial Information Services System (SLIK).

This adjustment was triggered by changes in the banking supervision structure which has now shifted from Bank Indonesia to OJK.

So, how do you access and check BI Checking? Check out the complete review below which was summarized on Tuesday (27/02/2024).

1. BI Checking Credit Score

With BI Checking, you can determine whether the customer's credit is functioning properly or not.

There are five BI Checking scores to evaluate, namely Score 1: Good Credit, Score 2: Special Attention Credit (DPK), Score 3: Non-performing Credit, Score 4: Doubtful Credit, Score 5: Bad Credit.

2. BI Checking Requirements

There are requirements to complete the BI Checking or iDeb application that can be submitted by debtors, businesses, or deceased individuals.

These include, ID cards, passports (for foreigners), and tax identification numbers (for business debtors).

For deceased individuals, original documents are required to provide official information about the debtor's death from the authorized party, as well as documents that can prove family relationships or heir status.

3. Check BI Checking Online (SLIK OJK)

For BI Checking, you can also do it online or through SLIK OJK.

There are several ways to do the checking, including through the iDebku OJK website, through IDScore.id, Skor Life Application, and through the Cekaja.com website.

4. Offline BI Checking

In addition to online, BI Checking can also be done offline or by visiting the tax office according to your domicile.

Here are the steps to do offline BI Checking:

-

Prepare the necessary documents as required.

-

Visit the nearest Financial Services Authority (OJK) office.

-

Complete the provided form and submit supporting documents as instructed.

-

OJK will conduct the verification process and the results will be sent to your registered email address. This way, the reporter can obtain information about credit history directly from the related OJK office.

5. How to Clean BI Checking

Here's how to remove bad BI Checking notes and can be done if the score is low, for example, a score of 3 due to arrears or late payments:

-

Immediately pay off outstanding credit or debt. It is important to pay off debts on time because credit approval decisions by financial institutions depend on perfect credit records.

-

After paying off the debt, observe changes in the BI Check record. If the score does not change, send a written clarification to the relevant bank.

-

Include an explanation letter or clarification from the bank where the credit application was made and ensure confirmation to the Financial Services Authority (OJK) that the credit obligations have been fulfilled.

-

Wait for official confirmation that the BI Checking record has been removed. By following the following steps, you can restore your credit report to a better position and improve your previous bad BI Check score.

6. How to Check BI Checking Yourself?

By visiting the website https://idebku.ojk.go.id.

7. What Application to Use for BI Checking?

Quoted from another source, for those familiar with 'BI Checking', the checking has now changed to SLIK or OJK Financial Information Service System.

8. How to Check if There is a Loan Using KTP?

Quoted from another source, this checking is done online through the website idebku.ojk.go.id, which can also display someone's loan history and credit status.

(kpl/sma)

Disclaimer: This translation from Bahasa Indonesia to English has been generated by Artificial Intelligence.