Kapanlagi.com -

Reporting annual taxes is an obligation for citizens who are taxpayers. Currently, reporting annual taxes can be done more easily and practically online, making it more efficient. However, in reality, there are still many taxpayers who do not understand how to report annual taxes online.

Annual tax reporting is submitted in the form of a Tax Return (SPT). The Annual SPT includes calculations of tax owed, tax payments, and other information such as income and assets. Although it may sound complicated, timely SPT reporting becomes easier when done online.

Here is a review of the guide on how to report annual taxes online that can be done easily and practically.

1. Understanding Annual Tax

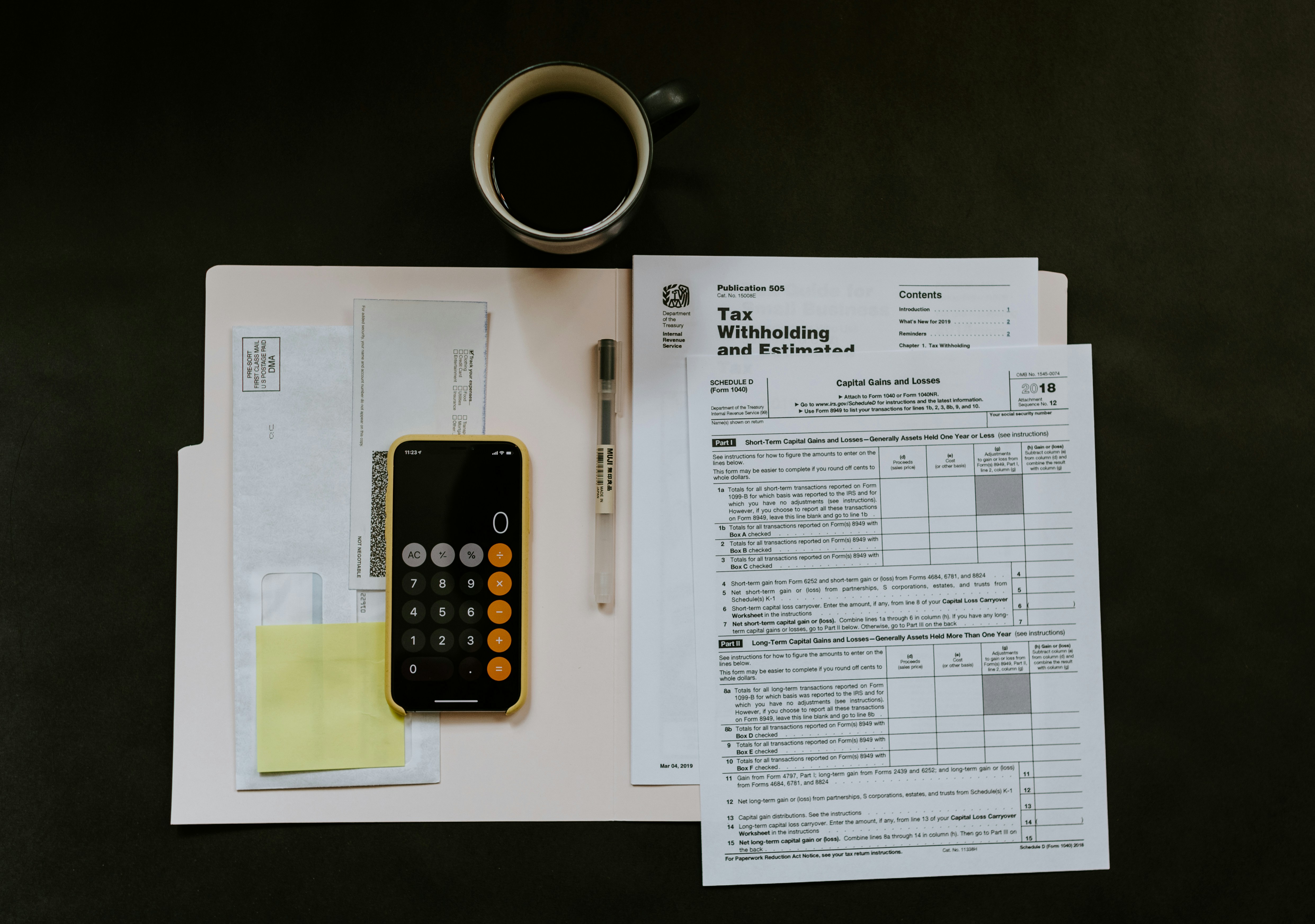

Definition of Annual Tax (credit: unsplash)

The Annual Tax Return (SPT) is a mandatory document that you need to submit as a Taxpayer. This document is used to report the calculation and payment of taxes owed within a year. Through the Annual Tax Return, you can account for your tax obligations accurately.

In addition, the Annual Tax Return also serves to report tax payments, sources of income, assets, and other obligations. By reporting the Annual Tax Return on time, you contribute to the development of the country and avoid administrative sanctions.

The benefits of reporting the Annual Tax Return include:

Ensuring compliance with tax regulations.

Knowing your tax status, whether underpayment, overpayment, or zero.

Avoiding penalties due to late reporting.

Contributing to national development through the taxes paid.

2. Types of Annual Tax Return Forms

Every Taxpayer has different form requirements for the Annual Tax Return. Choose the Annual Tax Return form that suits your tax situation so that reporting can be done correctly. Each type of form is designed to accommodate the needs of Taxpayers based on income sources and employment status.

By knowing the appropriate type of form, you can ensure data completeness and avoid errors in reporting. Here is an explanation of the types of Annual Tax Return forms:

1. Annual Tax Return 1770 SS

Suitable for those of you who work for one company throughout the year with an annual gross income below Rp60 million.

2. Annual Tax Return 1770 S

Used by employees with income from more than one employer or annual income above Rp60 million.

3. Annual Tax Return 1770

This form is for Taxpayers with income from businesses, freelance work, or other sources such as self-employed individuals, doctors, or consultants.

4. Annual Tax Return 1771

This form is specifically for business entities such as companies or legally established foundations.

3. Preparation Before Reporting Taxes Online

Preparation Before Filing Taxes Online (credit: unsplash)

Before starting to report taxes online, make sure all necessary documents and tools are ready. Thorough preparation helps facilitate the reporting process and reduces the risk of technical or administrative errors. These initial steps are important so that you can fulfill your tax obligations smoothly and efficiently.

Here are some things you need to prepare before filing your annual tax report online:

1. Taxpayer Identification Number (NPWP)

Ensure your NPWP is active for tax administration purposes.

2. Electronic Filing Identification Number (EFIN)

EFIN is required to log in to the DJP Online service. If you do not have one, apply at the nearest tax office.

3. Supporting Documents

Prepare documents such as tax withholding receipts, asset lists, liabilities, and financial reports if necessary.

4. Stable Internet Access

Ensure your internet connection is stable to avoid issues during the reporting process.

4. How to File Taxes Online through DJP Online

How to File Taxes Online through DJP Online (credit: unsplash)

Filing taxes can now be done easily through the DJP Online service. The process is quite simple and allows taxpayers to complete their reporting without having to visit the tax office.

Here are the easy steps to file your Annual Tax Return online:

1. Open the DJP Online Website

Access the DJP Online page through your browser on your device.

2. Log in to your DJP Online Account

Enter your NPWP, password, and security code. If you do not have an account yet, you need to register first.

3. Select the e-Filing Menu

After successfully logging in, select the "Report" menu and click "e-Filing".

4. Start Creating SPT

Click "Create SPT" and answer the questions to determine the type of form that suits your situation.

5. Fill in the SPT Data Carefully

Enter the requested data according to the supporting documents. Make sure there are no mistakes in the filling out.

6. Double Check the Data

Before submitting, ensure all data has been filled out correctly.

7. Submit SPT

Click "Submit SPT" and enter the verification code sent via email or registered phone number.

8. Save the Proof of Receipt

After successful submission, download and save the Electronic Receipt Proof (BPE) as evidence that the tax reporting has been completed.

By following this guide, online tax reporting can be done quickly and easily without the need to queue at the tax office.

That’s a review on how to report taxes online. Now, you understand each process of online tax reporting, even from the preparation stage. If not now, when else?

(kpl/psp)

Disclaimer: This translation from Bahasa Indonesia to English has been generated by Artificial Intelligence.