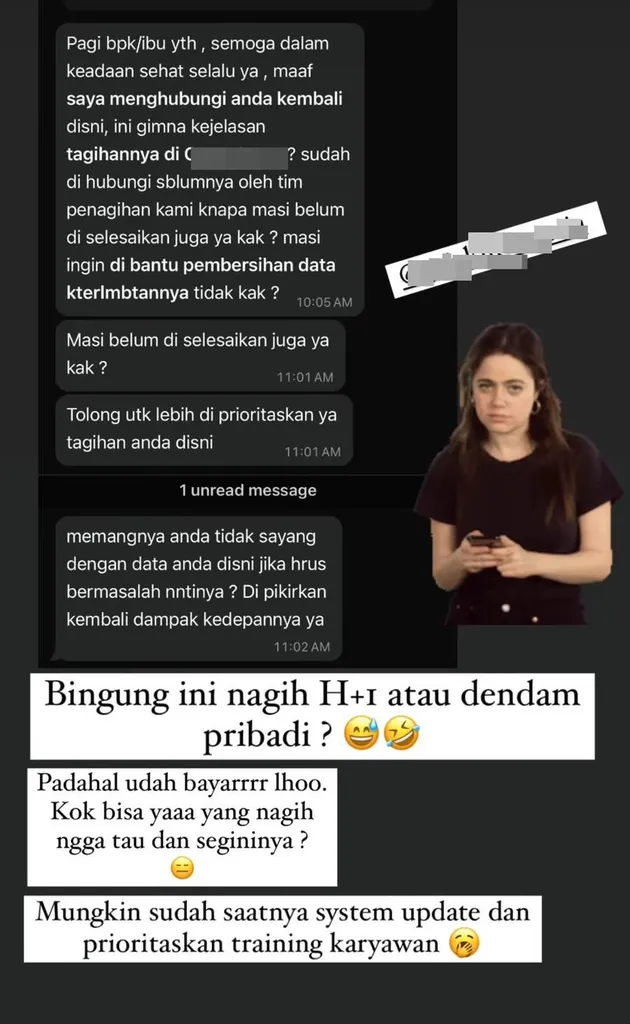

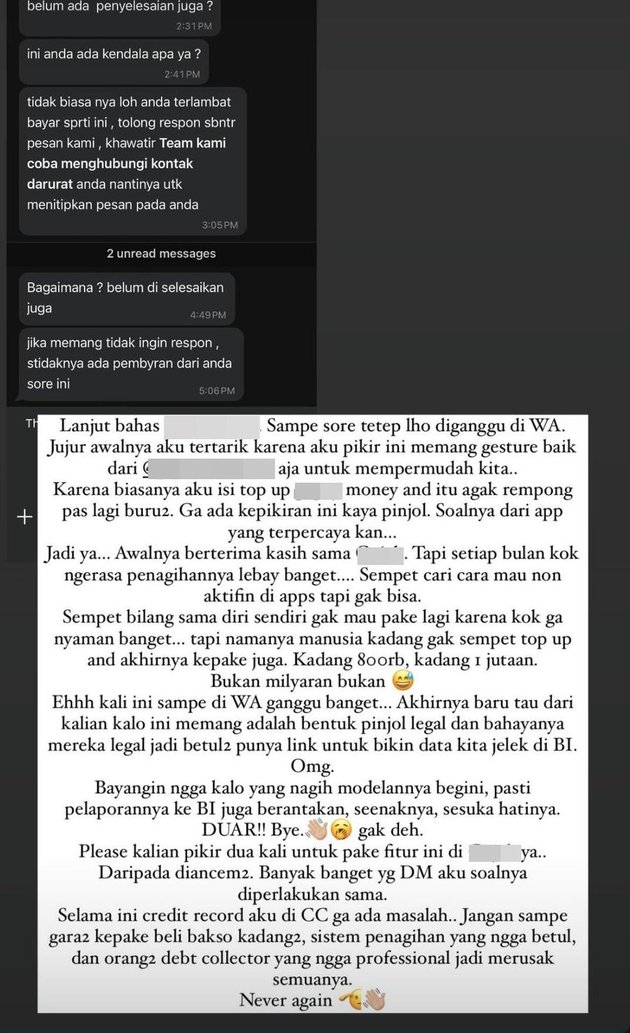

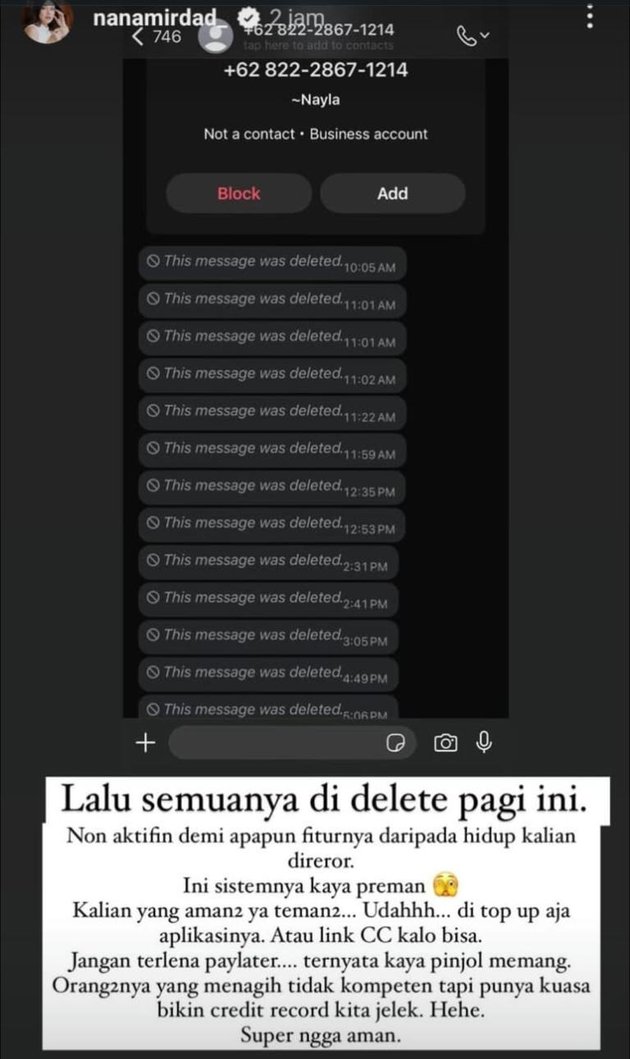

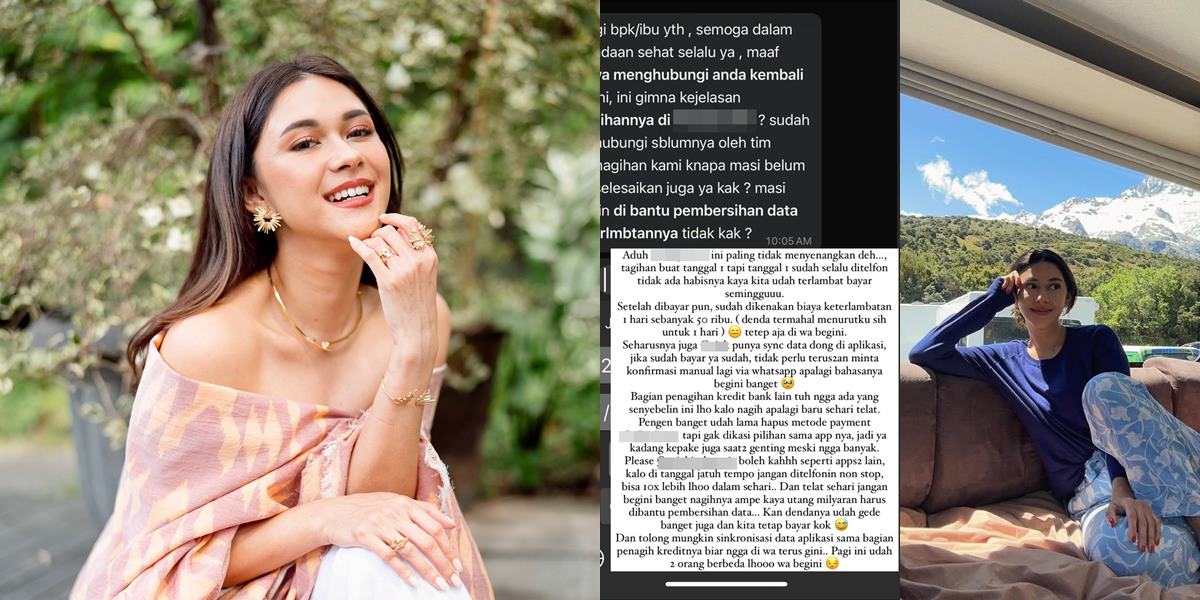

Artist Nana Mirdad became a public topic after sharing an unpleasant experience while using the paylater service from one of the online motorcycle taxi applications. Although the billed amount was relatively small, Nana still experienced terror from a debt collector and had to pay a fine that she deemed unreasonable.

This experience serves as an important reminder for the public about the hidden risks of paylater services, which are actually categorized as legal online loans (pinjol). Here are some tips to avoid falling into the trap of paylater or online loans.