Kapanlagi.com - QRIS is a term that is no longer unfamiliar. QRIS is one of the digital payment systems in Indonesia. QRIS enables efficient and practical financial transactions using barcodes or QR codes. Therefore, it is now important to know how to make QRIS barcodes.

In daily life, QRIS plays a crucial role as an alternative contactless payment method. The advantage of QRIS lies in its accessibility through barcodes. With QRIS barcodes, consumers and merchants can quickly and conveniently confirm transactions through smartphones.

For merchants, QRIS is something that greatly supports the development of their business in the future. Moreover, making QRIS barcodes is very easy. If you are curious about how to make QRIS codes, you can read the following review:

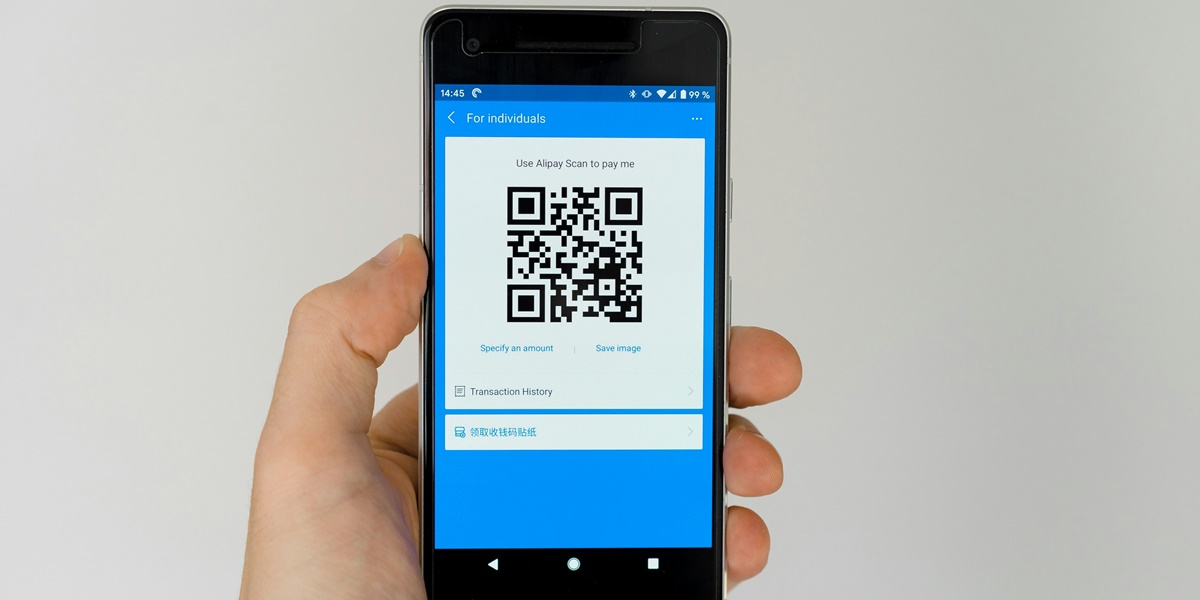

1. What is QRIS

What is QRIS (credit: unsplash)

QRIS stands for Quick Response Code Indonesian Standard. As mentioned earlier, QRIS is part of the digital transaction process in Indonesia. QRIS is one of the digital payment standards accessed using QR codes developed by Bank Indonesia.

The implementation of QRIS in Indonesia aims to increase financial inclusion, facilitate cashless transactions, and support the development of the digital payment ecosystem.

This standard ensures that the payment system using QRIS can be accessed by various payment service providers (PJP) who have obtained permission from Bank Indonesia. With QRIS, the payment process becomes more efficient and user-friendly, following the development of global payment technology.

QRIS provides efficient and practical payment methods using QR code technology. Through QRIS, users can easily make payments or transfer funds using banking applications or digital wallets that support QRIS.

QRIS also enables various types of payments, including purchases at physical stores, online transactions, bill payments, and interbank transfers. Each QRIS contains information related to customers and merchants, enabling quick and accurate payment processes.

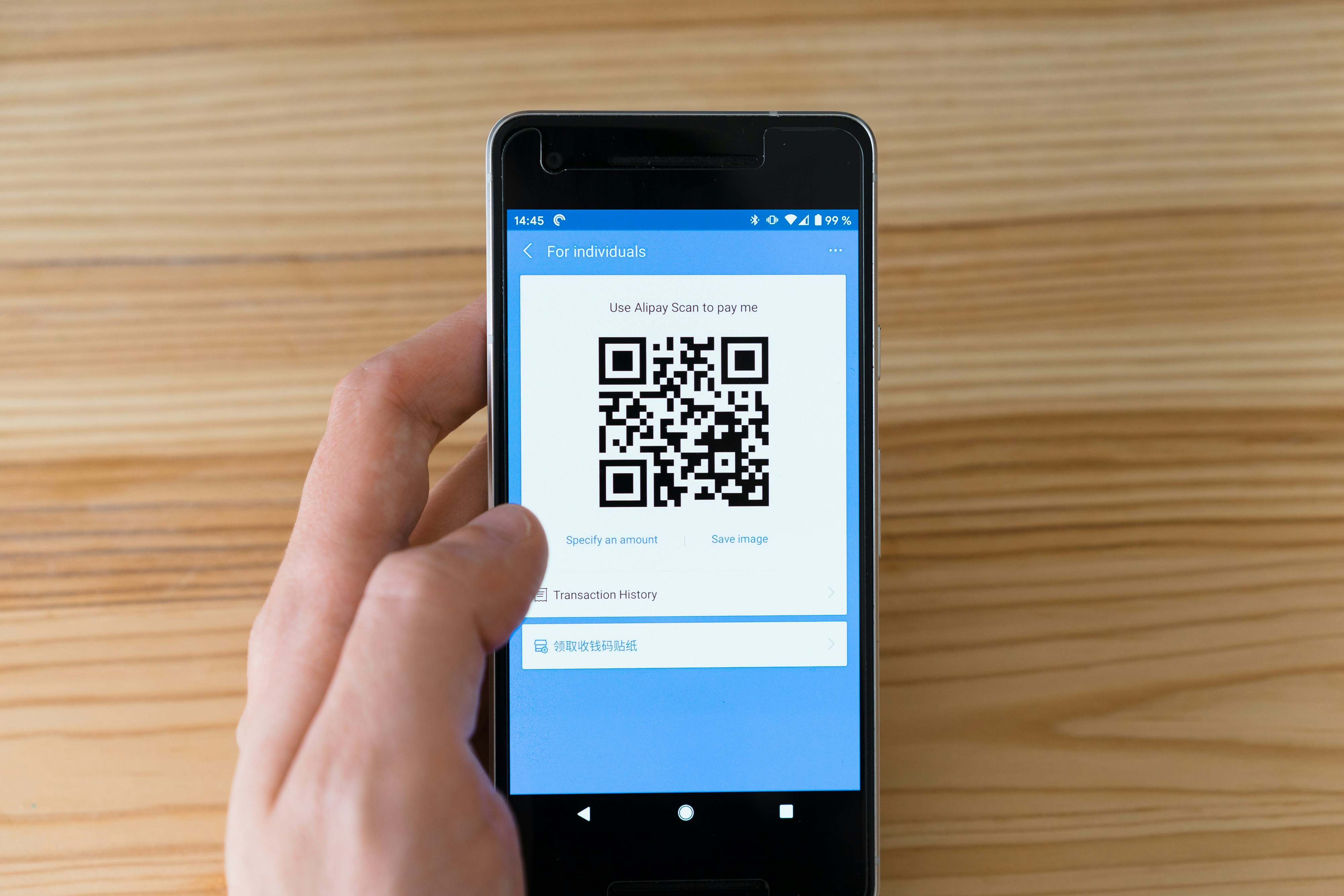

2. How to Create QRIS Barcode for Merchants

How to Create QRIS Barcode for Merchants (credit: unsplash)

QR codes have now become part of people's lives. QR codes can be found in stores and even street vendors. This is because every merchant can register for QRIS through a special procedure. As reported on the official website of Bank Indonesia bi.go.id, here is a guide on how to create a QRIS barcode:

1. Choose a Bank Indonesia Licensed QRIS Payment Service Provider

Choose a Payment Service Provider (PJP) that has been licensed by Bank Indonesia. Information about licensed PJP can be found on the Bank Indonesia website under the category "QRIS".

2. Visit or Register Online at QRIS PJP

Visit the licensed PJP office or register online through their official website. Online registration can also be an easy option.

3. Wait for Verification and Get Merchant ID

After registration, wait for the document verification process. If accepted, the PJP will provide you with a Merchant ID and a special QRIS code for your business.

4. Use QRIS Merchant

Your QRIS Merchant is ready to use after completing the above steps. Display the QRIS barcode at the payment location or near your store's cashier.

5. Pay Attention to Fees and Requirements

Remember that the fees and registration requirements for QRIS may vary between PJP. For more information on fees and additional requirements, contact the QRIS PJP you have chosen.

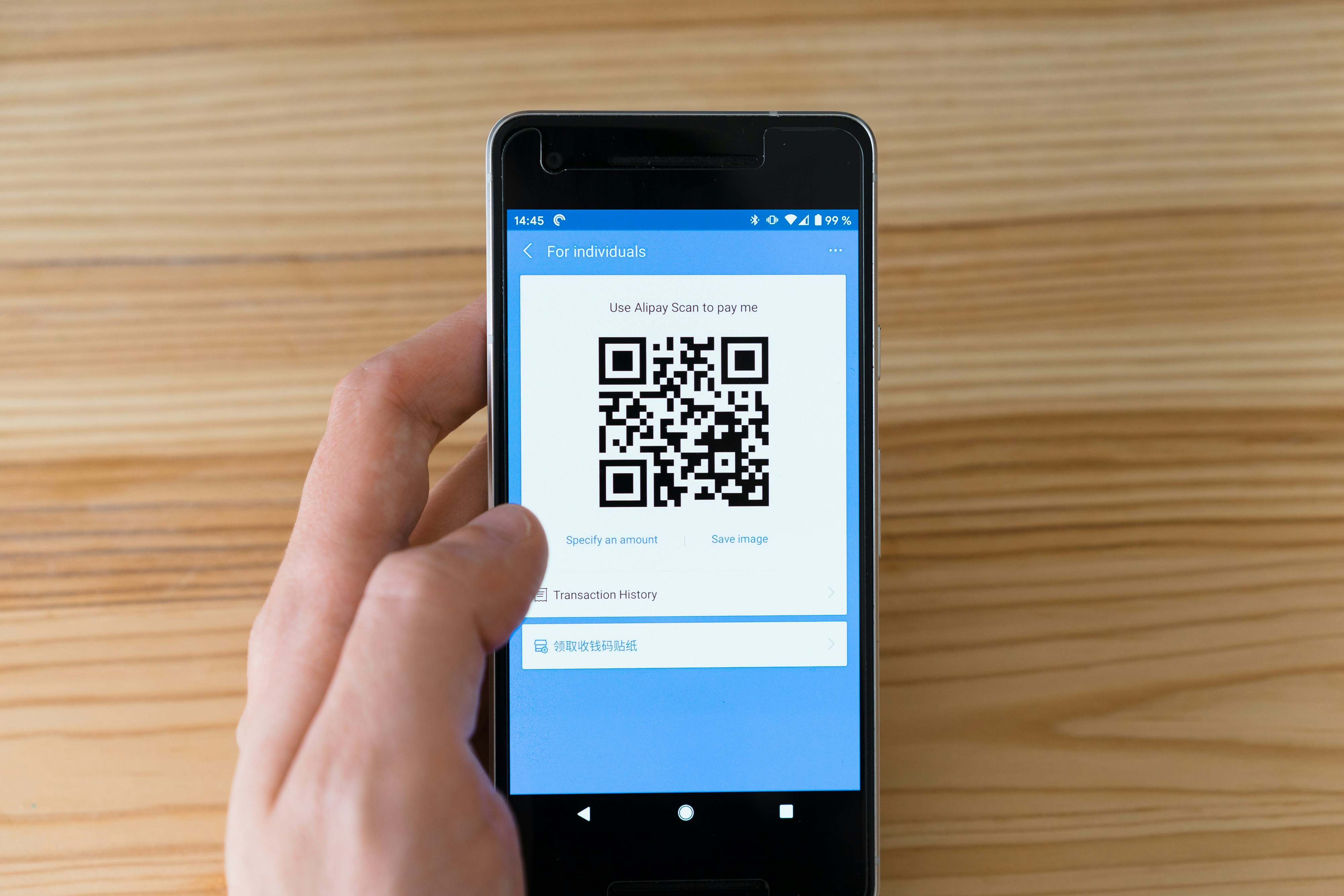

3. Benefits of Using QRIS

Benefits of Using QRIS (credit: unsplash)

QRIS has become the official digital transaction in Indonesia. Although it has not been used for long, QRIS is already relied upon by merchants and consumers. There are various benefits of using QRIS for merchants and consumers. Here are some of the benefits of using QRIS:

1. Quick and Easy Payment

With QRIS, the payment process becomes very fast and easy. You just need to scan the QR code using a banking application or digital wallet, and the transaction is completed without the need to carry cash.

2. Various Types of Transactions

QRIS supports various types of transactions, ranging from purchases at physical stores, online transactions, to bill payments. You can use QRIS for various payment purposes.

3. Cashless

A major advantage of QRIS is that it allows you to transact without cash. This provides convenience and security, especially in the current digital era.

4. Financial Inclusion

The use of QRIS also supports financial inclusion by providing wider access to the public to participate in digital payment systems.

5. Transaction Tracking

QRIS provides accurate transaction tracking. You can easily view the payment history and transactions that have been made.

Those are some explanations on how to create QRIS barcode for merchants. Hopefully, it is useful and good luck!

JOIN OUR WHATSAPP CHANNEL TO STAY UPDATED WITH THE LATEST ENTERTAINMENT NEWS FROM INDONESIA AND ABROAD. CLICK HERE, KLOVERS!

(kpl/psp)

Disclaimer: This translation from Bahasa Indonesia to English has been generated by Artificial Intelligence.